How do vehicle tax deductions work?

Donating a car to Good News Garage (GNG) is a win-win! Not only are you serving others through a vehicle donation, but in doing so, you may receive a generous tax deduction.

If a tax deduction is an important consideration for you when selecting a vehicle donation program, GNG is the perfect fit. We are one of the few car donation charities in the country that can offer a fair market tax deduction. This means that if a neighbor in need is awarded your car, you may qualify for hundreds, even thousands, more in vehicle tax deductions. This is significantly more in deductions than other charities may be able to offer. You may even be eligible to receive the most generous vehicle tax deduction as allowable by law. This is great, but if you don’t know much about taxes, it can seem a bit confusing. To make the tax world a bit easier to understand, we’ve outlined some key information below.

Qualifying for a Vehicle Tax Deduction

There are a few things to keep in mind when making a charitable contribution. For example, you can only deduct contributions to charity if you itemize deductions on your Schedule A of Form 1040 (don’t forget to do that when filing your taxes!). That being said, it is important to take into account that there are certain limitations on charitable contribution deductions. For example, your deduction, in this case, your vehicle tax deduction, cannot exceed 50% of your adjusted gross income. Publication 526, Charitable Contributions, lays out the specific information on claiming deductions and the deduction limits. It is available online at https://www.irs.gov/.

How to determine the amount you can deduct?

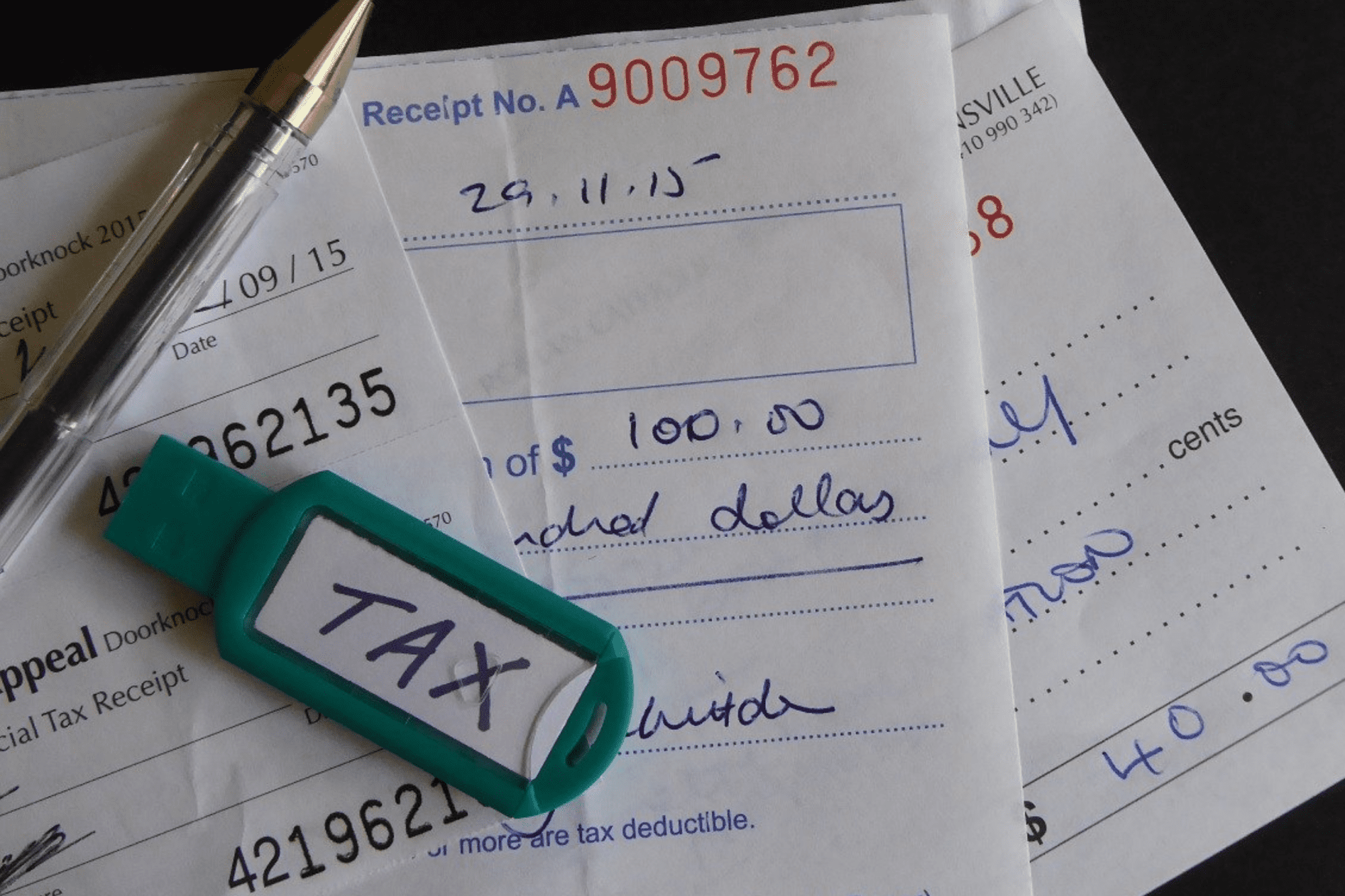

The amount you may deduct for a vehicle contribution depends on what we, the given charity, decide to do with your vehicle (which will be reported in the written acknowledgment you will have received from us). For any donated vehicle, there is an automatic $500 minimum vehicle tax deduction. Thus, for any vehicle donation you make to GNG, you will be receiving at least a $500 deduction if you itemize your taxes.

One of the benefits of donating to GNG is that we also award cars to those in need; we do not only sell them. Because of this, we are able to offer significantly bigger tax deductions based on the fair market value applied, which puts you in a better position than if you donated to other charities. Other charities may also provide donors with gifts. This may seem like a nice gesture, but when gifts are received in exchange for a donation it can have a negative effect on the amount you can claim as tax-deductible.

What is the ‘fair market value’?

The fair market value is the price a willing vehicle buyer would pay and a willing vehicle seller would accept, in which neither party is compelled to buy or sell. For example, if your donated car is worth $4,500, you qualify for a $4,500 deduction on your taxes.

If you have any remaining questions, please feel free to check out our Donation FAQs page: https://goodnewsgarage.org/donation-faqs/.